The 60/40 portfolio, comprised of 60% equity benchmarks and 40% bonds, has remained a cornerstone of the wealth management industry for many decades. Its enduring value and efficiency as an optimal allocation strategy – i.e., the highest return for a certain level of risk – have solidified its status as a benchmark for moderate-risk investment strategies that can be tailored into variations, e.g., conservative (or 20/80) or aggressive (or 80/20) portfolios. Yet, the recent surprising and disappointing performance of the strategy has triggered a fierce debate over its long-term value. This debate however misses the broader lesson. While the 60/40 cookie-cutter practice is indeed obsolete, the criticism over its validity has, if anything, renewed interest in efficient and optimal portfolio construction in line with Markowitz’s teachings and at the core of the 60/40 approach itself!

With today’s avalanche of free data, computing power, AI, digital platforms, financial innovation, and availability of low-cost ETFs and zero-commission brokerage, there are powerful tools to build highly diversified and customized portfolios closely matching the investor’s risk tolerance profile and goals ... a quantum leap from the cookie-cutter 60/40 strategy and its indiscriminate conservative, moderate, and aggressive variations.

First, some history …

The 60/40 approach is possibly the most popular application of Markowitz's Nobel Prize-studded modern portfolio theory (MPT). Markowitz's seminal work was founded on a fundamental mathematical observation: When the components of a portfolio are not perfectly correlated, the overall risk of the portfolio, measured by the standard deviation of returns, will be lower than the weighted sum of the risks of individual components. Additionally, if there is a negative correlation (as advocated by economic theory) between assets such as bonds and equities, losses incurred in one asset class can be offset by gains in the other. In essence, Markowitz's work emphasized the power of diversification in portfolio management. By intelligently selecting assets with low or negative correlation, investors can achieve higher returns for a given level of risk or reduce risk for a desired level of return – a concept often described as the "free lunch" in finance.

In addition to its academic rigor, the 60/40 portfolio gained popularity due to its simplicity in execution. Typically, this strategy involves investing in two or three broad equity benchmarks, predominantly focused on the U.S. market with some allocation to international equities and a smaller portion in emerging markets. Similarly, it entails allocating to a couple of bond benchmarks, primarily U.S.-based with some international and corporate exposure for added diversification. John Bogle, renowned as the father of passive investment and a strong advocate of the 60/40 portfolio, recommended a streamlined approach utilizing just two passive funds. He suggested investing in a U.S. equity fund (advising against international equities as he believed the efficiency and potential returns were inferior) and an intermediate-bond fund with a maturity ranging from five to seven years. This simplified execution made the 60/40 portfolio accessible to a wide range of individual investors focusing on long-term goals rather than navigating complex investment decisions.

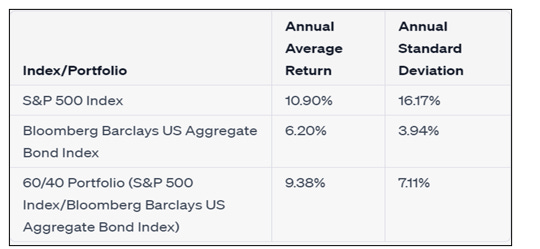

A compelling attraction of the 60/40 has been its excellent and consistent performance for decades. Over the 50 years from 1971 to 2021, utilizing the S&P 500 as the equity component and the Bloomberg Barclays US Aggregate Bond Index as the bond component, this portfolio has returned an annual average return of 9.38%. In comparison, the equity benchmark returned barely 20% more, or 10.90%, but with twice the volatility (see table below)! The real bonus behind this outstanding performance was the bond component turning out to be a crucial source of return in addition to being a diversifier considering its very low correlation with equity (~ 0.15).

That was until the wake-up call of 2022!

Was the 60/40 success all about a big bond rally? Yes …

In the first quarter of 2022, a sudden surge in inflation and aggressive monetary policy tightening led to sharp declines in both bond and equity markets. Surprisingly, the losses in equities and bonds were nearly equal, with both asset classes experiencing a decline of around 16%. By the end of the year, equities and bonds had lost 18.13% and 13.01%, respectively. Initially dismissed as short-term fluctuations, the surprising losses have caused many to question the validity of the 60/40 approach, particularly considering the substantial losses in bonds. Indeed, the resulting raging debate highlighted an inconvenient truth: The attractive performance of the 60/40 portfolio was in large part attributable to the historical and uninterrupted bond-market rally (see graph below), an event unlikely to be repeated!

While it is rational to expect the correlation between bonds and equities to eventually revert to its historically low norm, there are equally rational and thorough arguments predicting a continued rise in real yields back to their “natural” level (... and a decline in bond prices). Consequently, the 60/40 portfolio can no longer be relied upon as a winning, passive strategy justified by its historical returns. Rational analysis suggests that the landscape has shifted[i], necessitating a sharper assessment of the 60/40 performance going forward.

Back to the real Markowitz? Yes, finally …

The ongoing debate surrounding the validity of the 60/40 portfolio has sparked renewed interest in efficient and optimal portfolio construction, aligning with the principles laid out by Markowitz. The discussion has emphasized the importance of utilizing a proper optimization process to determine the optimal asset allocation rather than relying on a predetermined (preconceived!) 60/40 allocation as a one-size-fits-all approach.

The discussion highlights the need to move beyond a simplified approach and embrace more sophisticated methods to achieve optimal portfolio construction, considering individual investment objectives and a broader range of asset allocation and investment selection possibilities. It highlights the benefits of a much more extensive universe of uncorrelated opportunities to diversify risk and increase return.

Markowitz's groundbreaking work in 1952 coincided with a time when the investment landscape was relatively limited, offering few choices to investors. It took several decades for various investment options to emerge and gain recognition. For instance, the first index fund was introduced in 1976 by John Bogle and Vanguard. Real estate investment trusts (REITs) were established by the Congress in 1960. The advent of junk bonds occurred in 1977 (although more correlated with equities than with bonds). The launch of the first S&P 500 exchange-traded fund (ETF) took place in 1993, coinciding with the acceptance of emerging-market bonds as an investment option. Private equities became more accessible for trading in the late 1990s. The concept of factor investing gained acceptance in the 1990s and 2000s, following the influential work of Eugene Fama and Kenneth French. With so many not perfectly correlated alternatives, Markowitz’s work and diversification principles would be even easier to prove!

There are now ~11,000 (and counting) ETFs providing cheap and effective exposure to countries, markets, asset classes, factors (e.g., growth, value, low-volatility, etc.), sectors, industries, and themes (e.g., ESG), forming an extensive treasure trove for the modern wealth manager willing and able to embrace MPT. The menu for the free lunch is now extensive, varied, and Michelin-starred!

Most relevant is what goes into each bond and equity bucket. Limiting the composition to two or three highly aggregated benchmarks ignores the power of diversification and optimization. It assumes that all securities within the benchmark have the same return, volatility, and correlation structure. Such a narrow approach fails to fully harness the benefits of portfolio construction and snubs the famous free lunch of portfolio construction at the expense of the investor.

Is there only one efficient frontier? Yes ... one for each separate set of investment alternatives

Rather than relying on the 60/40 and its variations derived from a theoretical efficient frontier, investors can benefit from a more tailored (and practical) approach to portfolio construction. First, they select their investment universe, and then apply MPT to build a bespoke efficient frontier[ii]. The key concept is to prioritize the alignment between the investment universe and the investor's objectives by selecting a set of investments suitable to individual risk preferences and objectives. For instance, a conservative investor seeking capital preservation would find little value in including highly volatile assets like bitcoin or private equities in their portfolio. Conversely, an aggressive investor with a focus on capital growth would not benefit from allocating resources to utilities or intermediate treasuries.

By adopting this approach, investors can build portfolios that are better suited to their individual circumstances, allowing for more effective risk management and the pursuit of their specific investment objectives. Customization ensures that portfolio composition reflects the investor's risk profile and goals, resulting in a more targeted, optimized, and successful investment strategy. This is very much in line with Markowitz's teachings. He never postulated that MPT should be applied to a (theoretical) single set of investments out of which is built a single frontier. He simply optimized the set of investment alternatives he selected by diversifying.

The 60/40 may be dead … but MPT thrives

While the 60/40 approach may rapidly become obsolete, the debate over its value has bolstered the teaching of MPT and stressed the benefit of extensive diversification as the most efficient portfolio construction methodology. Proper asset allocation presents challenges compared to the traditional 60/40 approach. But with the avalanche of data, computing power, digital platforms, and availability of low-cost ETFs and zero-commission brokerage, the task of building customized portfolios that closely match the investor’s risk profile and goals is easier and rapidly becoming the norm.

This shift represents a quantum leap from the old cookie-cutter solution. As technology continues to evolve, customization in portfolio construction, i.e., selecting the set of investment alternatives first and then optimizing, will be the new norm in the wealth management industry.

Simon Nocera is the founder, managing partner, and CIO of Lumen Global Investments (LGI), a San Francisco-based investment and investTech firm, providing asset allocation and portfolio construction solutions with its digital investment application.

[i] For example, and assuming that the recent bout of inflation may be temporary, there is the nagging issue of Quantitative Tightening, or the Central Banks’ aspiration to shrink their balance sheet back to “canonical” levels, which will continue to put downward pressure on bond prices for the foreseeable future.

[ii] Following this approach, LGI has devised a set of Predefined investment universes classified by risk tolerance (conservative, moderate, aggressive), objective (Income, capital preservation, capital accumulation), and style (factor-tilted, global passive), each then generating specific Efficient Frontiers. Visit www.lumenr4a.com